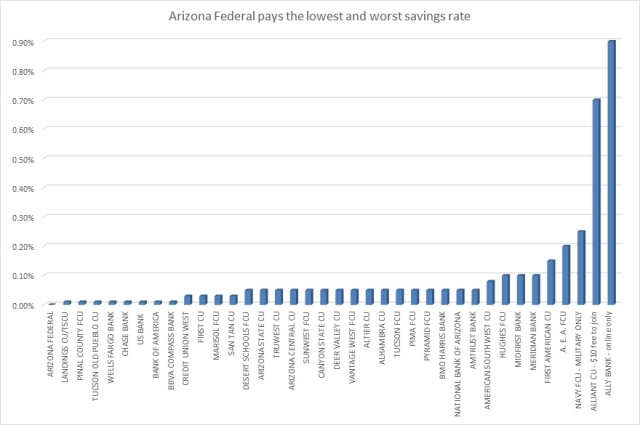

AZ FCU hopes you won’t realize they have the worst rates. Not only do they pay a low 0.01% interest rate on savings, they also charge $36 every year to every member. With a $10,000 share savings balance, at other credit unions, you will be saving $35 to $119 more than you would at AZ FCU. Restated, if you stay at Arizona Federal, you will be losing $35 to $119 more if you allow yourself to be pickpocketed for $36 every year at AZ FCU, compared to moving your money to a bank or credit union that doesn’t stick it to you. At AZ FCU, you are paying more in costs, but receiving less in benefits. In 10 years, you would be better off by $350 to $1190 more at somewhere other than AZ FCU. The sooner you move your money, the better.

https://arizonafederalcreditunionmembers.wordpress.com/2014/10/20/arizona-federal-pays-the-lowest-and-worst-savings-rate-at-azfcu-org

AZ FCU’s competitors allow you to keep more of your own money and save more money. Not only do other banks and credit unions have lower fees, they also pay higher rates. Don’t be bamboozled by Arizona Federal.

https://arizonafederalcreditunionmembers.wordpress.com/2014/10/20/how-do-other-banks-and-credit-unions-compare-to-az-fcu-with-10000-in-your-share-savings-account-move-your-money

AZ FCU thinks you are bad at math. If AZ FCU charges $6 million in annual member fees, then pays out $3 million as a “loyalty dividend,” you are collectively losing $3 million! In such a case, Arizona Federal members are only getting 50% of their money back. It’s similar to how casinos and lotteries advertise people winning money, without discussing how much they lose! When you look at the total return on investment picture of casinos, lotteries, and AZ FCU, you will realize they are foolish “investments” where you get back far less than what you invest.

$36 in annual fees is not necessary to provide services like online banking, remote deposit, etc., as these services can easily be found elsewhere.

https://arizonafederalcreditunionmembers.wordpress.com/2013/04/01/asmarterchoice-org-lists-alternative-credit-unions-in-your-area/

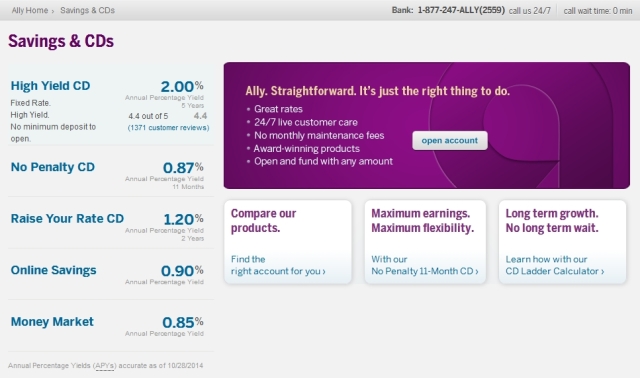

At AZ FCU, you would need about $500,000 in your share savings account to earn enough interest at 0.01% to cover the $36 in annual membership fees. If you took that same money and deposited at Ally Bank at 0.84%, you would earn about $4200. Add in the $36 in annual fees you won’t have to pay at Ally Bank, and you would be ahead by about $4200+$36 = $4236!

https://arizonafederalcreditunionmembers.wordpress.com/2014/10/05/how-much-money-on-deposit-do-you-need-at-arizona-fcu-to-recover-the-36-in-annual-fees-about-500000/

AZ FCU doesn’t care if you stay with them. “We are not for everyone,” they say. It is unwise to be where you are not wanted. A hostile environment is not healthy for you or your financial future.

AZ FCU thinks you are too lazy, complacent, and stupid to switch to a bank or credit union that values your business and gives you higher savings rates and lower loan rates.

https://arizonafederalcreditunionmembers.wordpress.com/2013/04/20/arizona-federal-credit-unions-competing-credit-unions-with-arizona-branch-locations-how-do-they-feel-about-their-members/

AZ FCU’s President, Ronald L. Westad, has destroyed his credibility. AZ FCU can no longer be trusted.

https://arizonafederalcreditunionmembers.wordpress.com/2013/04/11/in-2003-ron-westad-spoke-about-his-personal-values-and-beliefs-it-wasnt-a-matter-of-how-much-could-we-make-or-how-much-could-we-charge-members

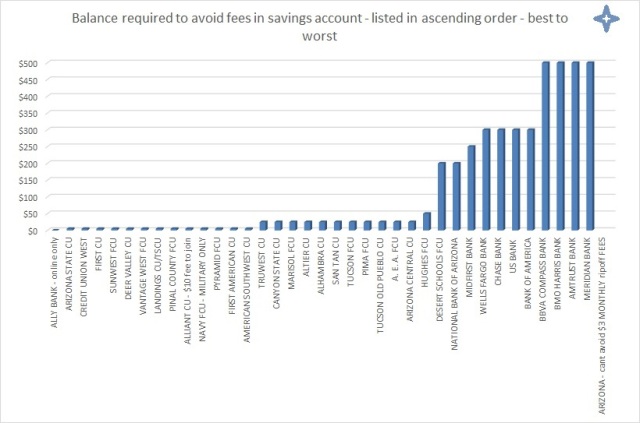

Arizona Federal Credit Union has some of the highest fees compared to alternatives. Be smart with your money and financial future. Move your money.

https://arizonafederalcreditunionmembers.wordpress.com/2013/04/08/arizona-federal-credit-union-has-some-of-the-highest-most-excessive-fees

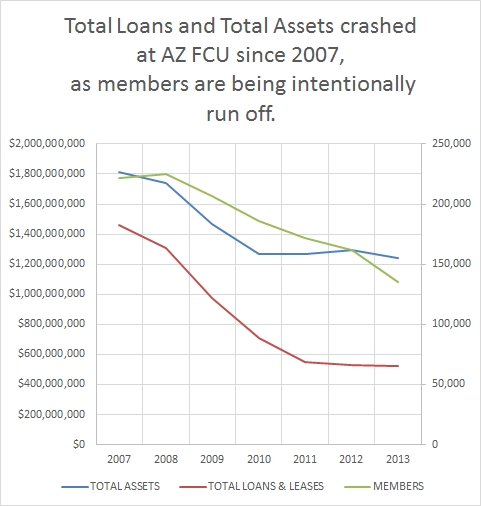

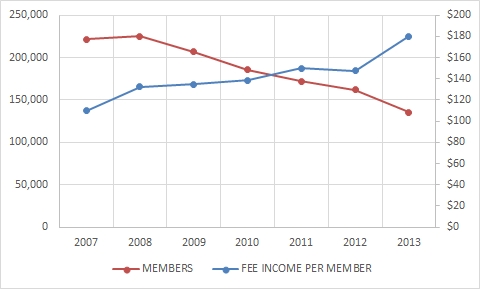

Over 35,000 of the smartest AZ FCU members left AZ FCU in just 1 year! That means, over 21% of the members got fed up and moved their money to where they don’t get charged unavoidable $3 monthly fees. They don’t want to be robbed by the unavoidable monthly $3 ripoff fees at AZ FCU, especially when there are countless alternatives that are better for your wallet.

https://arizonafederalcreditunionmembers.wordpress.com/2013/04/02/what-do-the-members-think-of-arizona-federal-credit-union-6-million-more-in-greedy-fees-for-not-listening-to-the-members